To install or update the AMA package, start R and enter: If you do not see it on the list or if you prefer using the R command line to install the package enter: Using the command line installation alternative will allow you to try to load the package.)

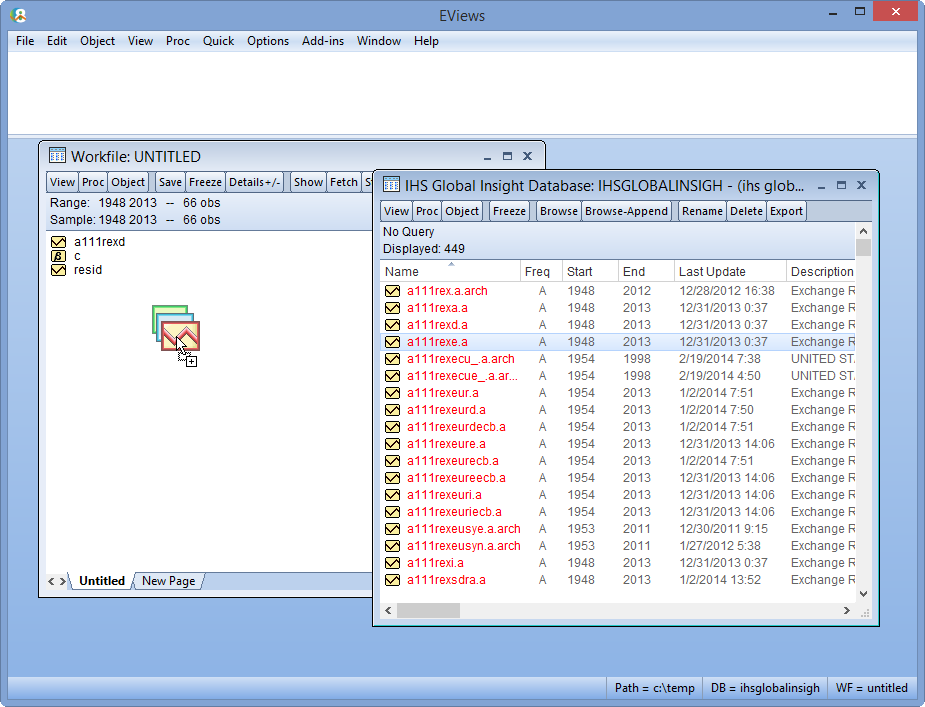

(The package may work for older versions of R, but it will not likely be available as a choice in the Load packages. Then, click on AMA to install the package. to get a list of packages to choose from. To install or update theAMApackage, start R and click on Packages > Load package. The EViews commands you will need to use from the EViews command line are xopen, xclose, xrun, xput, and xget.The first opens the connection to R the second closes this connection the third runs a command in that connection the fourth places an object into R and the fth brings an existing object in the R workspace into EViews. This comes automatically with almost all R distributions, however, and so you almost certainly already have it. Note: you need to have the `RJava' package installed. Consequently, it may be necessary to use an R that is version 2.11.0 or later. (This technology is also used by the package R.matlab) This R package has not been tested on R versions lower than 2.11.0.

EVIEWS COMMANDS SOFTWARE

(For Board computers, you will need to ask ARC to install this software.) This is the software that uses Microsoft's COM technology to connect EViews to R. as I recall) that suggests that you should choose the normalization (choose the dependent variable in the first-stage cointegrating regression) that maximizes the R-squared.You will need the "R and Friends" software, found here. If the results depend on the way the regression is normalized, which result do you choose? There's some old evidence (Dolado wet al.

Usually you would always include an intercept, and if you use a trend variable, you'd use it in every case. In that case, you can choose different variables as the LHS variable in the cointegrating regression, The choice you make can affect the outcome of the test. The literature you're referring to is the Engle-Granger 2-step method of testing for cointegration, and applies only to the case where all of the variables are I(1). There's no reason to try different choices of dependent variable. If you're using an ARDL model, then you've already decided on a dependent variable. I look forward to hearing from you on this important matter Sir. In total I have 11 regressors with a sample of 42 annual observations. The regressors that I have included are investment, human capital, population growth, government consumption, real interest rate, real exchange rate, inflation and fixed regressors (dummy variable for multiparty democracy, foreign aid, commodity price and foreign direct investment). Or in other words, what is the limit on the number of regressors that I can include with a sample with 42 observations. Can I still proceed with this regression estimation and what would be the effect on degrees of freedom. However, I am concerned about the number of regressors (both fixed and dynamic) that are being generated from my ARDL growth equations - at least 22 parameters (including both short and long-run coefficients). I am running three country-growth equations in Eviews 9 and I have 42 observations for each country (1970-2013). I wanted to ask you a question related to ARDL. Just wanted to thank you for the blog on ARDL estimation which has helped me a lot. The gasoline prices are in Canadian cents per litre, and they exclude taxes. The oil prices are measured in Candian dollars per cubic meter. So, the price data that we'll use are weekly (end-of-week), for the 4 January 2000 to 16 July 2013, inclusive. Although crude oil prices are recorded daily, the gasoline prices are available only weekly. More specifically, the crude oil price is for Canadian Par at Edmonton and the gasoline price is that for the Canadian city of Vancouver. Here, I'll take you through another example of ARDL modelling - this one involves the relationship between the retail price of gasoline, and the price of crude oil. What's now available is a full-blown ARDL estimation option, together with bounds testing and an analysis of the long-run relationship between the variables being modelled. It certainly deserves a post, so here goes!įirst, it's important to note that although there was previously an EViews "add-in" for ARDL models (see here and here), this was quite limited in its capabilities. This is a great feature, and I just know that it's going to be a "winner" for EViews. So, it's great to see that EViews 9 (now in Beta release - see the details here) incorporates an ARDL modelling option, together with the associated "bounds testing". My previous posts relating to ARDL models ( here and here) have drawn a lot of hits.

0 kommentar(er)

0 kommentar(er)